INSURANCE TECHNOLOGY SOLUTIONS

Delivering Alignment with Speed and Results Across the Enterprise.

EXPERTISE IN TECHNOLOGY SOLUTIONS FOR INSURANCE INDUSTRY

For the insurance industry, external risks keep escalating. Those risks range from accelerating climate change and evolving customer expectations to growing security exposures and mutating global pandemics.

Internal risks consist of managing a complex state of old applications and data, which are difficult to support, integrate and secure. Meanwhile, intermediaries, agencies and financial markets demand speed, responsiveness and agility.

Business leaders find valuable ways to handle these risks through innovative insurance technology. They are modernizing, designing, integrating and implementing flexible solutions across digital channels with speed and security.

That is what System Soft Technologies does. Here’s how we do it.

DEFINE AND INNOVATE YOUR VISION

System Soft collaboratively works and challenges our customers to accelerate change and deliver rapid digital experiences for their prospects, customers, agencies, intermediaries and employees. We stay intensely focused on using modern insurance technology solutions, which connects your vision to the tangible execution of automation. This is driven by intelligent automation in key process areas, such as:

- Product Launch

- Actuarial and Rate Filing

- Coverage Validation

- Claims Processing

- Underwriting

- Policy Management

- Regulatory Compliance

CREATE AN EXPERIENCE FOR FORWARD LOOKING INSURANCE COMPANIES

System Soft’s proprietary digital strategy and design method creates stakeholder experiences aligned with your organization’s digital branding guidelines, business case metrics, availability of data and the realities of current applications and technology.

For our insurance industry customers, we find rapid and pragmatic ways to use cloud, intelligent automation, artificial intelligence, data science and advanced integration technology to help our clients revolutionize relationships with their customers, trading partners and employees.

Our team will deliver constituent services, which embrace user experience best practices, user-centered design, self-curated functionality and innovation. Through a design thinking approach to better understand your user, challenge assumptions and redefine and solve problems, our team finds alternative strategies and solutions that are not at once clear. Then, we can deliver to you:

- Digital Strategy

- User Research

- User Experience

- User Interface Design

- Brand and Marketing

- Video Marketing

Our 90-Day Promise

Let us commit to establishing, piloting and prototyping digital solutions for Insurance clients in less than 90 days.

MANAGE CYBER SECURITY RISKS IN INSURANCE INDUSTRY AND PROTECT SENSITIVE DATA

System Soft can ensure maximum threat protection for your networks, applications, devices and programs from cyber-attacks, while helping your organization follow regulatory requirements.

Proactively migrate to protect against data breaches and hostile attacks with a higher level of compliance and regulation standards through:

- Vulnerability assessments and penetration testing to confirm your infrastructure's security posture and make your organization resilient to threats

- Assess security to test critical applications and high-risk transaction platforms for vulnerabilities to mitigate security risks

- Achieve regulatory compliance and develop incident response, business continuity and disaster recovery plans

- Controls review to evaluate safeguards for confidentiality, integrity and availability of information systems

- Security advisory and delivery

AUTOMATE AND STREAMLINE THE INSURANCE PROCESSES

Use robotic process automation (RPA) bots, intelligent automation (iA) inference engines and intelligent document processing (IDP) to automate high-volume processes for:

- Claims Processing

- Coverage Verification

- Underwriting

- Reinsurance

- Quotes

- Policy Cancelation

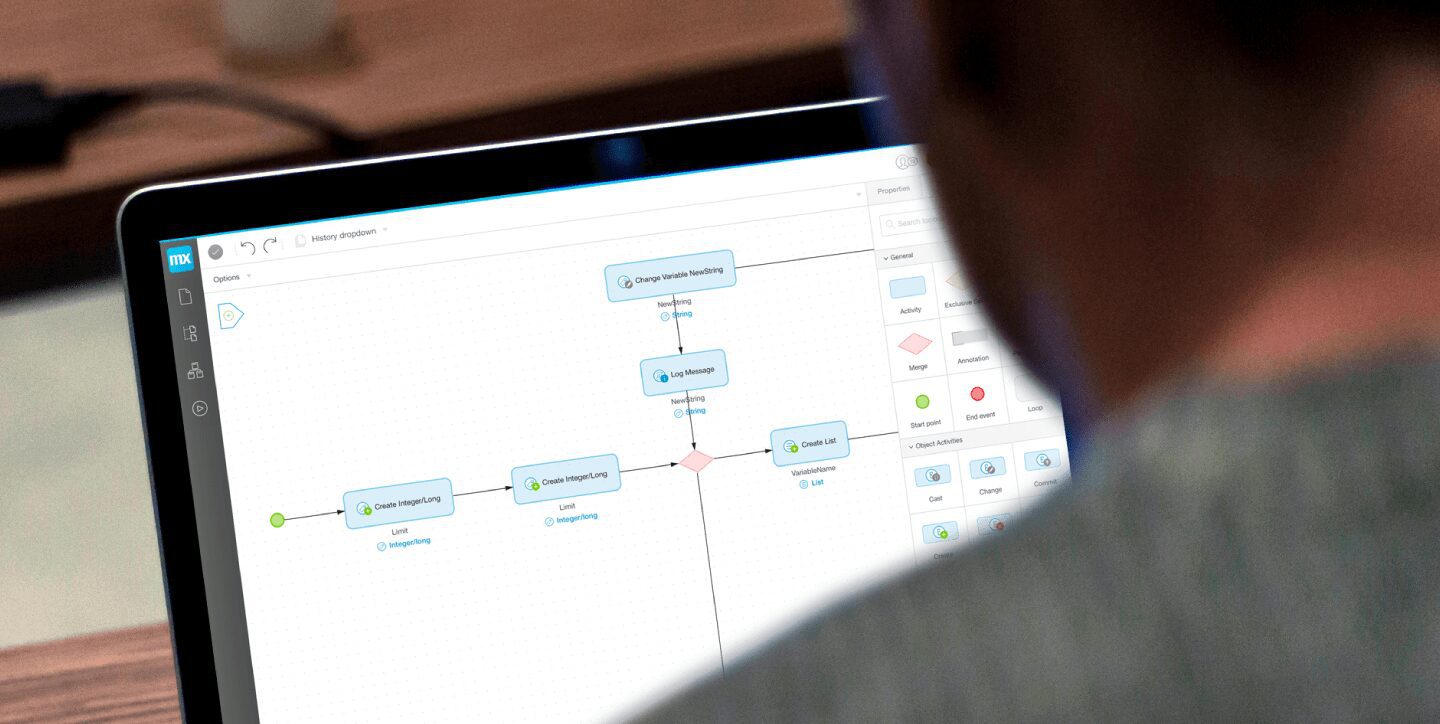

RAPID APPLICATION DEVELOPMENT AND INTEGRATION FOR INSURANCE TECHNOLOGY

Insurance companies with substantial technology investments in core systems like policy management need complementary applications quickly developed. These can be integrated with your core systems like agency integration, robotic process automation (RPA) and data warehouses.

System Soft Technologies’ approach can typically save your organization up to 40% as compared to traditional development technology and method.

Our integration technology services will transition your costly and complex legacy applications and data environments to cloud-based, agile and efficient environments, which are future-proof and cost-effective. These insurance technology solutions and services address the complex needs of insurance companies, which must comply with regulators, partners, intermediaries and customers.