In an era where systems and processes are constantly evolving, the banking industry is poised to leverage the remarkable potential of automation. This technological advancement holds the promise of making banking operations smarter, more efficient, and customer-centric, ultimately enhancing security and control.

Tech-savvy customers, led by millennials, have raised the expectations for seamless banking experiences. Automation-enabled mobile banking apps are empowering them with a new level of personalization, contextuality, and predictive capabilities, revolutionizing the way they interact with their banks.

The convergence of strong and swift processing capabilities, the proliferation of mobile technology, the abundance of data, and the advent of open-source software have presented an unprecedented opportunity for AI in the banking sector. AI is now at the forefront of the battle against fraudulent transactions and the enhancement of compliance. Capable of providing real-time, highly personalized services that resonate with customers, it is making it easy for them to relate to their financial institutions in meaningful ways.

Banks are uniquely positioned to seize this automation-driven opportunity

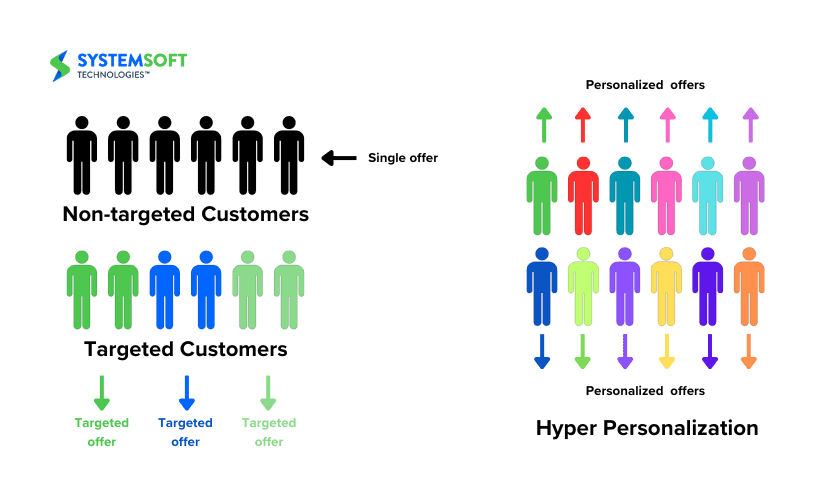

To offer tailored and relevant products to each of their customers. Customers have grown accustomed to receiving personalized product recommendations via mobile notifications, and hyper-personalization is becoming a powerful force in both the retail and banking industries.

The hyperautomation at HSBC[1][2][3] involves leveraging a combination of AI, Advanced Analytics, and automated decision-making to transform the bank into a digital enterprise. By automating and optimizing processes, HSBC aims to enhance customer experiences and drive innovation. The bank uses Robotic Process Automation (RPA) to handle repetitive tasks, allowing staff to focus on more valuable activities such as managing exceptions, conducting in-depth analysis, and building stronger client relationships.

This blog delves deeper into the concept of hyper-personalization, exploring how automation is the driving force behind the creation of highly customized experiences. It also provides essential guidelines for creating these experiences and highlights the benefits that both banks and customers can derive from this emerging trend.

Hyper-personalization – A Key Differentiator

Hyper-personalization is about using AI and insights from behavioral science to design products and services that cater to the unique needs and preferences of each customer. What sets hyper-personalization apart is its ability to adapt to changing customer demands and requirements over time.

In the past, retail banks often offered a standard set of products and services to all their customers. However, the tide of hyper-personalization is transforming the banking landscape, compelling banks to reinvent their offerings for each customer. This practice of hyper-personalization is now essential.

The driving forces behind hyper-personalization are twofold

First, customers’ requirements and demands are increasingly diverse and dynamic. Second, advances in technology have made hyper-personalization possible across various industries.

Customer service is emerging as a major differentiator, as customers now expect products and services tailored to their unique needs. They are gravitating towards banks that proactively adapt their offerings based on past interactions and anticipated future events rather than offering a one-size-fits-all approach.

Despite this, a surprising statistic reveals that 94 percent of banks have yet to fully embrace hyper-personalization in their offerings and advertising efforts. To bridge this gap, retail banks must tap into the wealth of data they have gathered during their digital transformation journey, encompassing transactional, behavioral, and interaction data. Utilizing AI and machine learning, they can extract valuable insights to better understand their customers and, ultimately, satisfy their needs.

Hyper-personalization is the untapped goldmine for retail banks

By personalizing each interaction with their customers, they can skyrocket their revenues and profits. Moreover, the development of open banking APIs and unique digital IDs for each customer will allow banks to engage and interact more effectively, generating more data to refine their services. Banks that embrace hyper-personalization now will gain a competitive edge over their peers who are slow to adapt.

Ways AI can Power Hyper-personalized experiences

In the ever-evolving world of retail banking, the integration of artificial intelligence has ushered in a new era of hyper-personalized experiences for customers. By harnessing the power of AI, banks create tailored interactions that not only cater to individual preferences but also enhance overall customer satisfaction and loyalty.

Here’s a closer look at how AI can shape these personalized journeys:

Personalized Recommendations and Offers

AI becomes the financial advisor of the digital age, sifting through vast customer data to identify patterns and trends. Imagine a bank that uses a customer’s past financial behavior to suggest products and services tailored to their unique needs. For instance, if a customer frequently saves for travel, the bank could recommend travel insurance or savings plans.

Predictive Analytics

AI’s predictive capabilities transform the banking landscape. Through AI-driven analysis, banks can anticipate customer needs and behavior. For instance, if a customer primarily uses mobile banking for transactions, the bank can craft a customized package that offers discounts on mobile-related services, ensuring a seamless and cost-effective experience.

Customer Service

AI brings efficiency to customer service through chatbots and virtual assistants. These AI-powered helpers provide personalized support, answering questions and resolving issues promptly. Customers can access assistance 24/7, ensuring that their needs are met in real-time.

Fraud Detection

The safety of customer finances is paramount. AI stands guard, monitoring accounts for suspicious activity and swiftly alerting bank staff to potential fraudulent transactions. This commitment to security instills trust in customers, knowing their financial well-being is protected.

Automation

AI takes on routine tasks, freeing up bank employees to focus on more complex and essential responsibilities. As AI-driven automation streamlines processes, efficiency increases, costs decrease, and customers benefit from a more convenient experience.

But AI’s potential in the banking industry extends beyond customer-centric initiatives:

Process Automation

AI eliminates errors and accelerates tasks such as account openings and transaction processing. By digitizing customer forms and automating document evaluation, banks save time and resources. This newfound efficiency allows staff to concentrate on enhancing customer-oriented operations.

Categorizing Fraud

In an era of escalating cybercrimes, AI is a valuable ally. It identifies and prevents fraudulent transactions based on predefined rules and behavior analysis. For instance, it can quickly flag large transactions from accounts typically associated with small transactions, safeguarding customer assets and bolstering cybersecurity.

Personalized Wealth Management

AI integrates into banking apps, offering personalized insights based on user behavior. It can guide users in financial planning, providing budgeting suggestions and related details. For example, when a customer expresses interest in buying a new car, the app can formulate a budget based on their current income and expenses.

Effective Decision Making

AI-powered cognitive systems assist bankers in making informed decisions. These systems access a wealth of expert information in real-time, enabling strategic and data-driven choices. By analyzing customer behavior and preferences, AI enhances operations, modernizes user experiences, and provides a deeper understanding of customer needs.

The applications of AI in the banking sector are vast, from underwriting and pricing to cash distribution and debt collection. These examples showcase how AI can revolutionize customer service, fostering stronger relationships and providing unmatched value in the digital banking landscape.

Guidelines for Creating Hyper-Personalization

In the fast-paced world of retail banking, where customer demands and expectations are constantly evolving, the art of hyper-personalization has become a game-changer. Imagine a world where every customer feels like the bank was created just for them – a world where banking experiences are not only efficient and convenient but also profoundly personal. This is the vision that the following guidelines aim to bring to life:

- The Power of Customer Data

Picture a vast reservoir of data drawn from various sources like customer interactions, transactions, and surveys. This data is the canvas upon which your bank will paint personalized experiences. By knowing your customers’ needs, preferences, and behaviors, you’re better equipped to serve them uniquely.

- AI and Machine Learning as Your Artists

These are the brushes and paints of hyper-personalization. With AI and machine learning, you’re not merely analyzing data; you’re crafting masterpieces. You can predict customer behavior, spotting patterns and trends invisible to the human eye, and then tailor the banking experience accordingly.

- Convenience at the Core

In this world, convenience reigns supreme. Customers expect to access their accounts and conduct transactions effortlessly from anywhere at any time. Technology is your loyal servant, ensuring their convenience is never compromised.

- The Human Touch in Virtual Assistance

Imagine AI-powered chatbots and virtual assistants as your bank’s concierges. These digital representatives swiftly resolve customer issues, providing personalized service that’s always just a click away.

- Guardians of Data

In this landscape, safeguarding customer data is a solemn duty. Fortify your bank’s walls with robust security measures, ensuring that personal and financial information remains safe and sound. This not only secures trust but also abides by the laws and regulations that govern this digital realm.

- Transparency as the Bedrock

Your customers are at the heart of your bank’s artistry. Be open and transparent with them about how their data is utilized to create these personalized experiences. This transparency builds trust and strengthens the bond between the bank and the customer.

Benefits of Employing Hyper-Personalization

Let’s explore the masterpieces you can craft and the profound impact they have:

- Sculpting Satisfaction

With hyper-personalization, customer satisfaction isn’t just a goal; it’s a masterpiece. Each customer feels like a valued individual, leading to a higher level of contentment and loyalty.

- The Art of Retention

By delivering a high-quality, personalized banking experience, you’re not just preventing customers from leaving; you’re creating art that retains them. Customer churn becomes a thing of the past.

- Loyalty as a Crown Jewel

Loyal customers are like cherished collectors of your art, and they’re more likely to stay, recommend your bank to others, and become your advocates in this vast, competitive art gallery.

- Standing Out in the Gallery

In the crowded market of banking, your hyper-personalized experiences become your masterpiece, differentiating you from competitors and drawing the gaze of potential customers.

- Monetary Rewards

As you sculpt satisfaction and loyalty, revenue flows naturally. Customers stick around, and new ones join the gallery, increasing your financial prosperity.

- Cost Savings, the Hidden Easel

Automation and AI not only create beautiful experiences but also trim operational costs, providing efficiency and convenience for both the bank and its customers.

Conclusion

Reimagine banking with System Soft’s hyper-automation solutions, leveraging advanced automation and AI to streamline processes and enhance efficiency within the banking sector. By automating tasks and processes, banks can unlock a wealth of benefits, including increased productivity, reduced operational costs, improved customer experiences, and strengthened competitive advantage.

System Soft offers cutting-edge automation tools and expertise to help banks optimize workflows, automate routine tasks, and implement robust security measures. Explore our solution and success story, and contact us to discover how hyper-automation can revolutionize your banking operations and propel your institution forward in today’s rapidly evolving landscape.