BANKING TECHNOLOGY SOLUTIONS

Redefine Banking Excellence with Speed and Results.

EXPERTISE IN DIGITAL BANKING TECHNOLOGY

The financial services leaders System Soft Technologies works with are under immense pressure to address a convergence of challenges confronting costs (compliance, security and legacy infrastructure) and top line pressure (digital native startups, always-on digital expectations and merger mania).

Meanwhile, customers and employees have elevated expectations for secure digital experiences in banking, which are personalized, holistic and available across channels of choice.

System Soft’s Financial Services Industry (FSI) vertical provides service offerings designed to address these challenges with pragmatic, rapid and secure delivery. We do so by harnessing modern and proven banking technology solutions and platforms complemented by deep sector expertise and digital experience creativity.

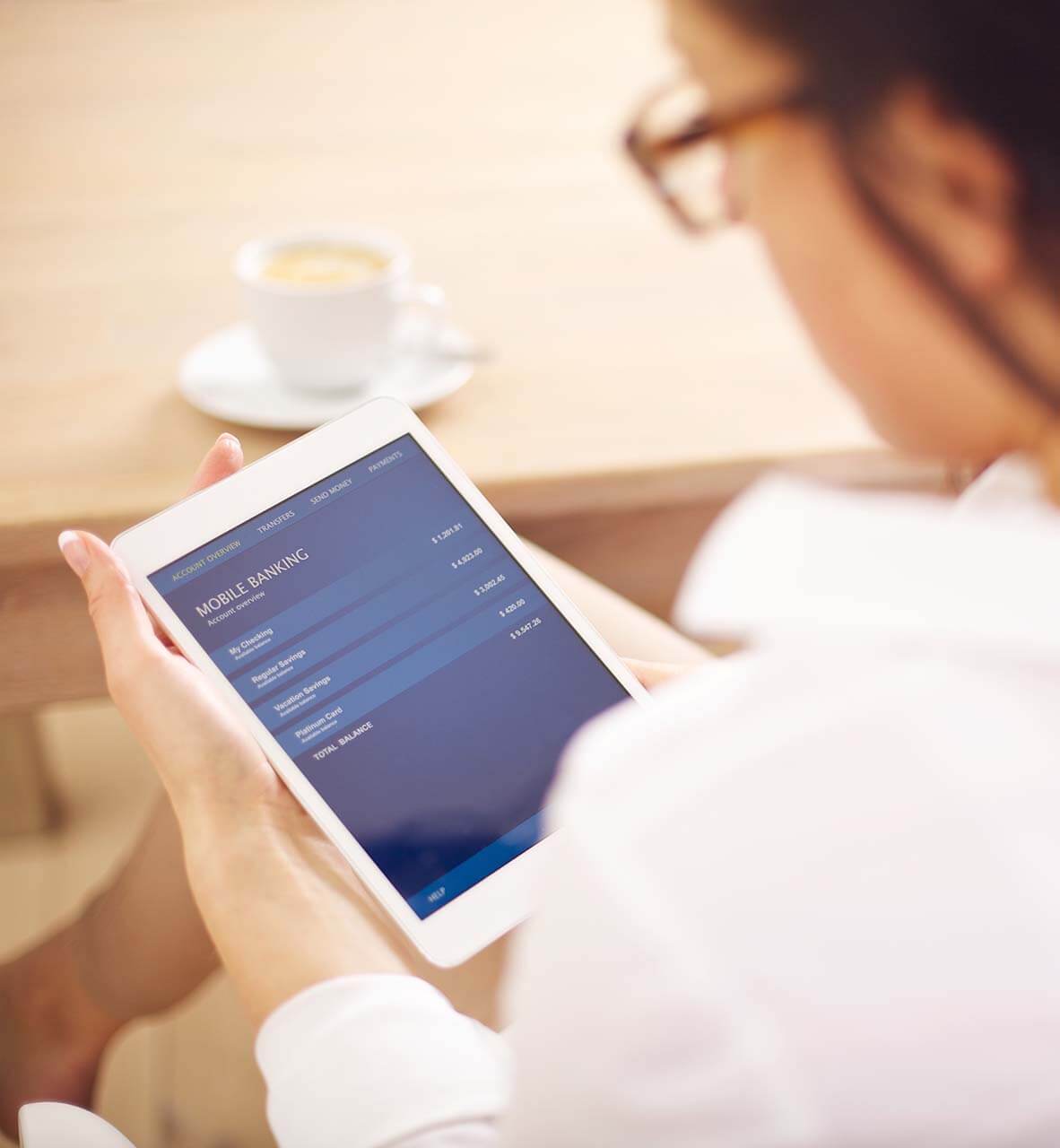

REINVENT THE CUSTOMER JOURNEY AND DIGITAL EXPERIENCES

System Soft helps banking clients revolutionize, expand and fortify relationships across channels of choice with their customers and employees in compressed timeframes with tangible business outcomes. We start with innovative user experience interfaces fueled by our Business Xelerator. System Soft Technologies Business Xelerator is comprised of digital strategists, user experience designers and solution architects who provide a templated single user interface with a holistic suite of features. Customers can then quickly:

- Leverage the user interface to integrate legacy applications and data to empower internal teams with valuable data and customer insights that otherwise sit outside a traditional, front-line CRM.

- Optimize operational and financial performance by establishing workflow and processes that cut out manual intervention and elevate transparency.

Then, we deliver creative vision through advanced technology capabilities, such as cloud, intelligent automation, artificial intelligence, data science and advanced integration platforms.

Our service offerings are oriented toward delivering banking IT solutions and digital experiences for customers, employees and trading partners, driving cost savings and top-line acceleration, with an emphasis on critical business functions, such as:

- Customer Relationship Management (CRM)

- Digital Marketing

- Compliance Management

- Global Payments

- Credit and Lending

- Wealth Management

- Global Markets

- Customer Banking

- Commercial Banking

TRUSTWORTHY BANKING TECHNOLOGIES TO MANAGE CYBER SECURITY RISKS AND PROTECT SENSITIVE DATA

Ensure maximum threat protection for your networks, applications, devices and programs from cyber-attacks and improve compliance efforts with regulatory requirements.

Proactively migrate to protect against data breaches and hostile attacks with a higher level of compliance and regulatory requirements through:

Vulnerability assessments and penetration testing. Validate your infrastructure’s security posture and make your organization more resilient to threats.

Security Assessment. Test critical applications and high-risk transaction platforms for vulnerabilities to mitigate security risks.

Compliance Review. Achieve regulatory compliance and develop incident response, business continuity and disaster recovery plans.

Controls review. Evaluate safeguards for confidentiality, integrity and availability of information systems.

Security advisory and delivery.

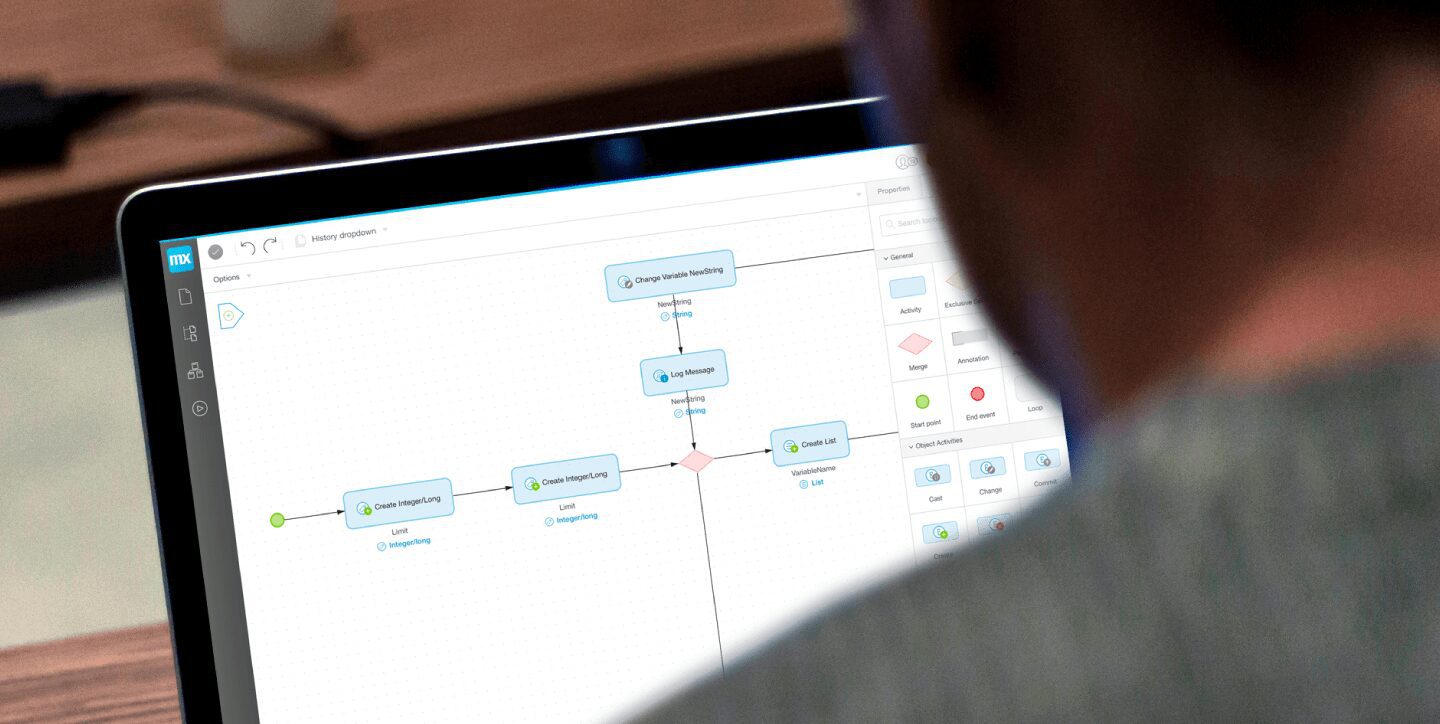

AUTOMATE AND STREAMLINE BANKING PROCESSES

Our approach integrates RPA with IA, inference engines and intelligent document processing to greatly expand the possibility and complexity of what can be automated. The result: high paid management resources are unencumbered to be reallocated to more productive and strategic bank initiatives.

- Loan Processing

- Credit Scoring

- Trade Finance

- Account Closure

- Card Management

- Funds Transfers

- Financial Reconciliation

- Audit and Compliance

Rapid Application Development, Integration and Cloud: Three Initiatives Every Bank is Pursuing

Many Financial Institutions must endure a substantial legacy of core technology that is old, complex, difficult to maintain and resident on old, premise-based hardware. Compounding this dilemma is the external and internal market forces requiring technology that is fast, agile, digital and mobile-oriented. Not a great situation, for sure. System Soft Technologies can help in three complementary ways.

System Soft can transition costly and complex legacy applications and data environments to cloud-based, agile, and efficient environments, which are future-proof and secure.

Connecting existing applications and data within and outside of bank borders is a fluid and growing challenge. System Soft’s Integration Technology Services focus on modern platforms that support digital enablement and light-speed connections with regulators, trading partners, intermediaries and customers.

Software development and maintenance backlogs far eclipse budget and resources available to keep up. Our low-code and no-code software development capabilities solve this problem and often reduce expenditure and time frames by 40%.

Our 90-Day Promise

Leverage System Soft’s Business Xelerator, digital experience practice, design-led workshops, rapid development platforms and advanced technology capabilities. Let us commit to establishing, piloting and prototyping digital solutions for FSI clients in less than 90 days.