In response to the evolving demands of customers for streamlined, efficient services, the banking industry is undergoing rapid transformation. In this era of digital transformation, low-code automation platforms are playing a pivotal role in reshaping the customer onboarding processes of banks and credit unions. These platforms represent a significant change in the way banks operate and serve their customers.

The Changing Landscape of Banking

Traditional methods of opening a bank account or getting a loan involved a lot of paperwork, a lot of trips to the bank, and a lot of waiting. Today’s customers expect immediate access to banking services, often without going to a physical branch. But as the digital age evolved, so did expectations.

Low-code development has emerged as a game-changer in the Banking industry in recent years. While this technology is not entirely new, it has become more accessible and user-friendly. It has redefined the industry, presenting unprecedented efficiency, agility, and customer satisfaction.

Key Goals in Banking

Banks need to focus on meeting the needs of their customers as well as enhancing operational efficiency, which includes reducing costs, as two of their primary objectives.

The Importance of Digital Onboarding in Banking

As technology advances, it is more critical than ever for banks to provide a seamless onboarding experience to their customers, especially in today’s technologically advanced era.

With digital onboarding, various automated functions can be performed, enabling faster Know Your Customer (KYC), Know Your Business (KYB), and Anti-Money Laundering checks. There are several compelling reasons for the importance of customer onboarding for banks, including:

- First Impressions Matter

Onboarding sets the tone for the customer’s relationship with the bank. A complicated or confusing process can discourage customers from continuing to do business with the bank. - Building Trust

Banks can establish trust with their customers during the onboarding process by clearly communicating their products and services and providing responsive customer service. - Fraud Prevention

Assuring a customer’s identity and making sure proper documentation is in place during onboarding reduces the risk of fraud. Not only is the bank protected, but the customer’s financial interest as well. - Repeat Business

When customers have a positive onboarding experience, they are more likely to remain loyal to the bank for a long time. On the other hand, if they have a negative onboarding experience, they may explore other options. - Building Brand Loyalty

Customers who are onboarded smoothly are more likely to remain loyal to that bank or brand. This loyalty is increasingly important in today’s competitive environment.

The Need for Analyzing and Optimizing Customer Onboarding

Customer onboarding is one of the areas where banks fall short. They need to recognize the importance of this critical process and take steps to analyze and optimize it to meet the demands of today’s digitally savvy and demanding customers.

Source: Forbes; Deloitte Analysis

Your customer onboarding process represents a valuable opportunity to improve customer experience and boost satisfaction levels. Initially, it represents a valuable opportunity to improve customer satisfaction levels. Additionally, it serves as an effective strategy for reducing customer churn, ultimately resulting in increased revenues and improved profitability.

Risk Assessment in the Customer Onboarding Process

Businesses and organizations identify, evaluate, and manage potential risks as part of the risk assessment process. To safeguard business objectives, it is crucial to ensure that these risks are not only recognized but also comprehended and managed appropriately.

Onboarding individuals or corporate clients requires an understanding of risk mitigation that goes beyond identifying these risks. This is particularly important. The use of Know Your Customer (KYC) and Anti-Money Laundering (AML) risk assessment checks plays a crucial role in ensuring compliance, preventing fraudulent activities, and providing insight into new client behavior.

Conducting KYC/AML Risk Assessments during Onboarding

KYC/AML risk assessments are typically conducted during the onboarding process for new customers. However, they can also be performed periodically when a customer’s activities or circumstances change.

Information about a customer’s identity, employment history, financial history, and other pertinent factors is gathered to accomplish this. As a result of these risk assessments, businesses can protect themselves against fraud and many other risks by performing them during onboarding.

Customized Rule Conditions for Comprehensive Risk Assessment

Risk assessment relies upon customization, enabling the establishment of multiple rule conditions. This facilitates the creation of an overall risk assessment and reveals a comprehensive view of a client’s risk status.

Businesses with such an approach can confidently engage with clients and tailor rules to suit the specific needs of different branches and countries.

Through transparency of data and risk variables, all stakeholders can access the information, thereby improving decision-making. Ultimately, this approach promotes risk-based decisions, ensures compliance with regulations and legislation, and optimizes business efficiency.

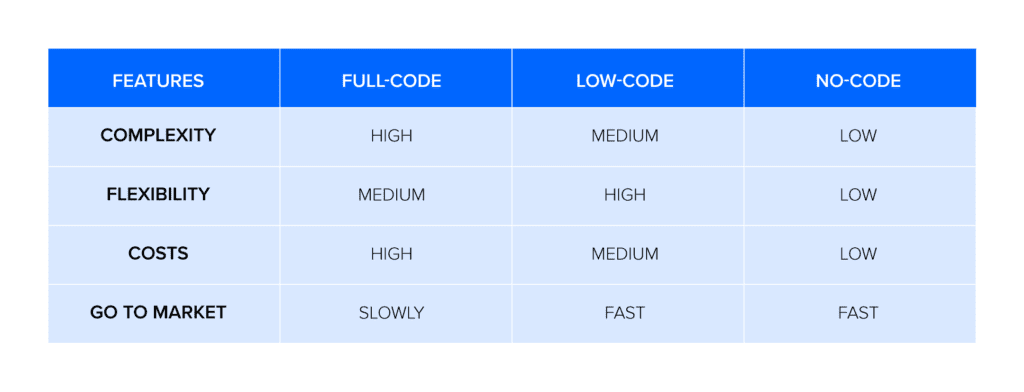

Understanding Low-Code Automation Platforms

With low-code automation platforms, businesses, including financial institutions, can develop customized software applications with minimal manual coding, making them versatile and user-friendly. By providing a visual interface, these platforms make it easier for developers and non-developers to create, deploy, and design applications.

Organizations with complex and extensive infrastructures face substantial challenges when implementing digital transformation initiatives. Typically, these initiatives required meticulous planning and extensive, high-risk development projects, which stretched timelines and budgets. Low-code platforms, however, have revolutionized the landscape as they have become enterprise-grade.

A low-code platform offers a completely visual development environment, eliminating the need for lengthy and intricate development cycles that are associated with traditional development methods. Even with limited development experience, anyone can design and build internal and customer-facing applications quickly.

The plug-and-play integration capabilities also enable the creation of applications with AI capabilities able to manage complex transactions across various backend systems.

Leveraging Low-Code

A low-code platform enables teams to develop AI-powered applications using application programming interfaces (APIs). In addition to swift customer query resolution, fraud prevention, compliance tracking, automated product recommendations, and AI-based automation, these applications offer many other advantages.

In the financial industry, low-code technology empowers financial institutions to innovate quickly and on a grand scale, whether the goal is to create customer-facing applications, streamline internal processes, or revolutionize product offerings.

Low-Code Automation vs. Robotic Process Automation

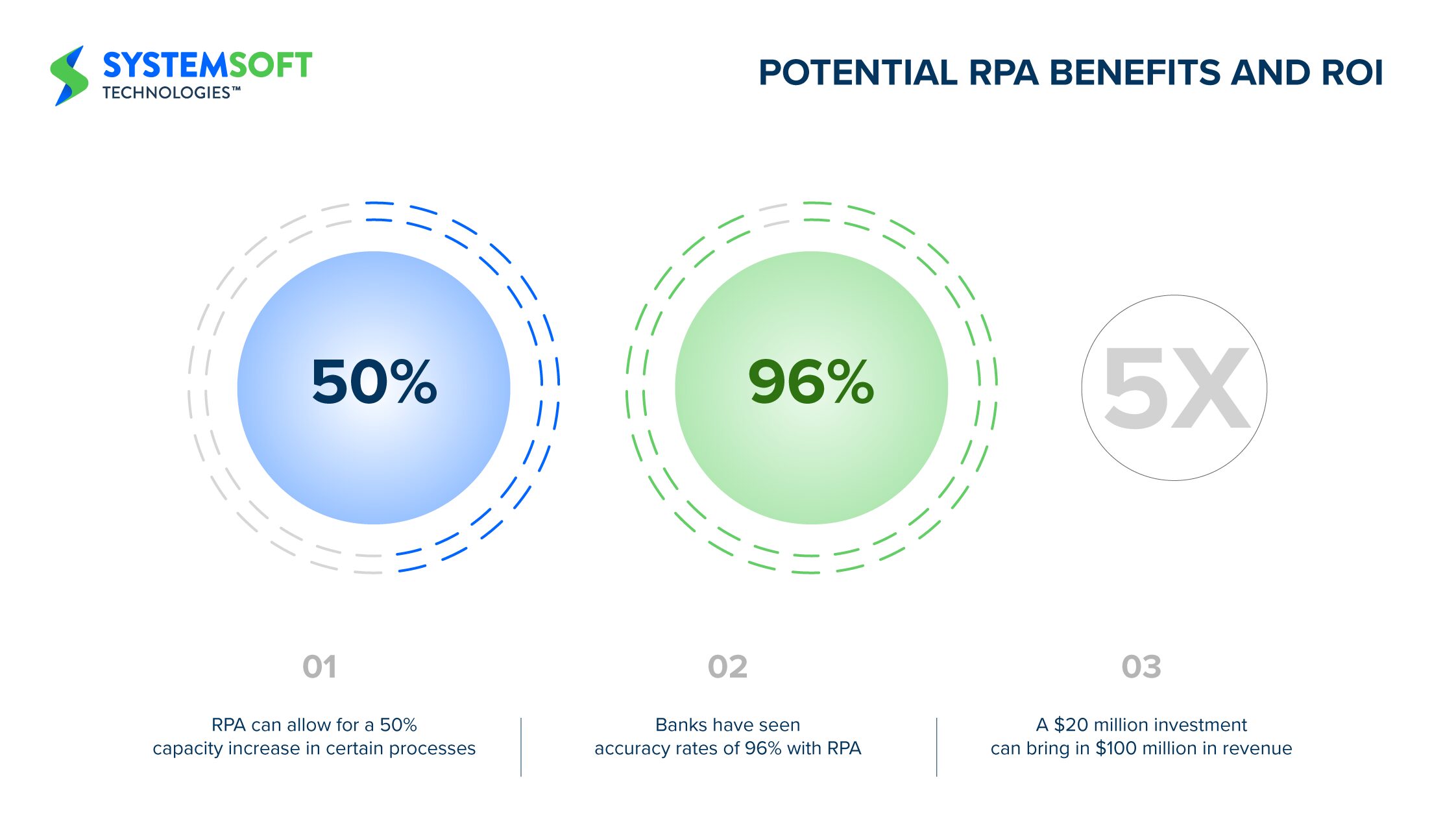

A second technology for automating business processes within organizations is Robotic Process Automation (RPA). In RPA, human actions are simulated within multiple software applications, allowing tasks to be automated efficiently, particularly in structured and rule-based applications.

RPA may have limitations for end-to-end process automation at a company-wide level. When it comes to integrating RPA micro-automation into larger processes, full- or low-code solutions become necessary. Compared to Robotic Process Automation, full- and low-code programming offers more development options.

Source: Deloitte Analysis

Benefits of Low-Code Automation for Financial Institutions

Low-code automation can save businesses an average of $4.4 million over three years, in addition to labor savings. It can also help to improve customer satisfaction and employee productivity. Furthermore, it can be used to rapidly create and deploy applications, allowing businesses to quickly respond to market changes.

Simplified Onboarding Procedures

Automation reduces the need for physical visits and extensive paperwork by automating the customer onboarding process by enabling customers to open accounts, apply for loans, and access banking services through their devices.

Elevated Customer Satisfaction

Automating routine tasks enables banks to spend more time and resources engaging in personalized customer interactions, which boosts customer loyalty.

Adherence to Regulations and Security

Data breaches and fraudulent activities can be reduced by integrating low-code platforms with robust security features.

Practical Implementations in the Real World

Automation of Lending Processes

Loan origination, approval, and repayment processes can be simplified with low-code loan automation tools that connect with client-side applications or bank websites. By leveraging AI/ML and RPA capabilities, these low-code platforms reduce loan processing times and associated risks. In low-code lending automation applications, multiple sources of data are combined to score and make credit decisions for borrowers.

Omnichannel Support Solutions

Banks offer intelligent banking support via their websites or customer applications. Low-code banking support bots can extract information from internal sources to answer frequently asked questions. Assisting customers who require specific services directs them to the right specialists.

Risk Management Applications

Data from a variety of sources, including social media and personal information, is aggregated by low-code banking applications for risk management. By utilizing these sources, low-code AI apps can gather data on demographics, credit history, social status, and other factors relevant to risk assessment.

Fraud Detection Systems

The low-code platform allows users to develop fraud detection software that detects suspicious activity, false customer information, and restricted transactions. The platform also allows users to define criteria to compare data against.

Enhancement of Internal Operations

By automating task assignment, enhancing cross-departmental collaboration, and maintaining data effectively, low-code applications can enhance internal banking operations.

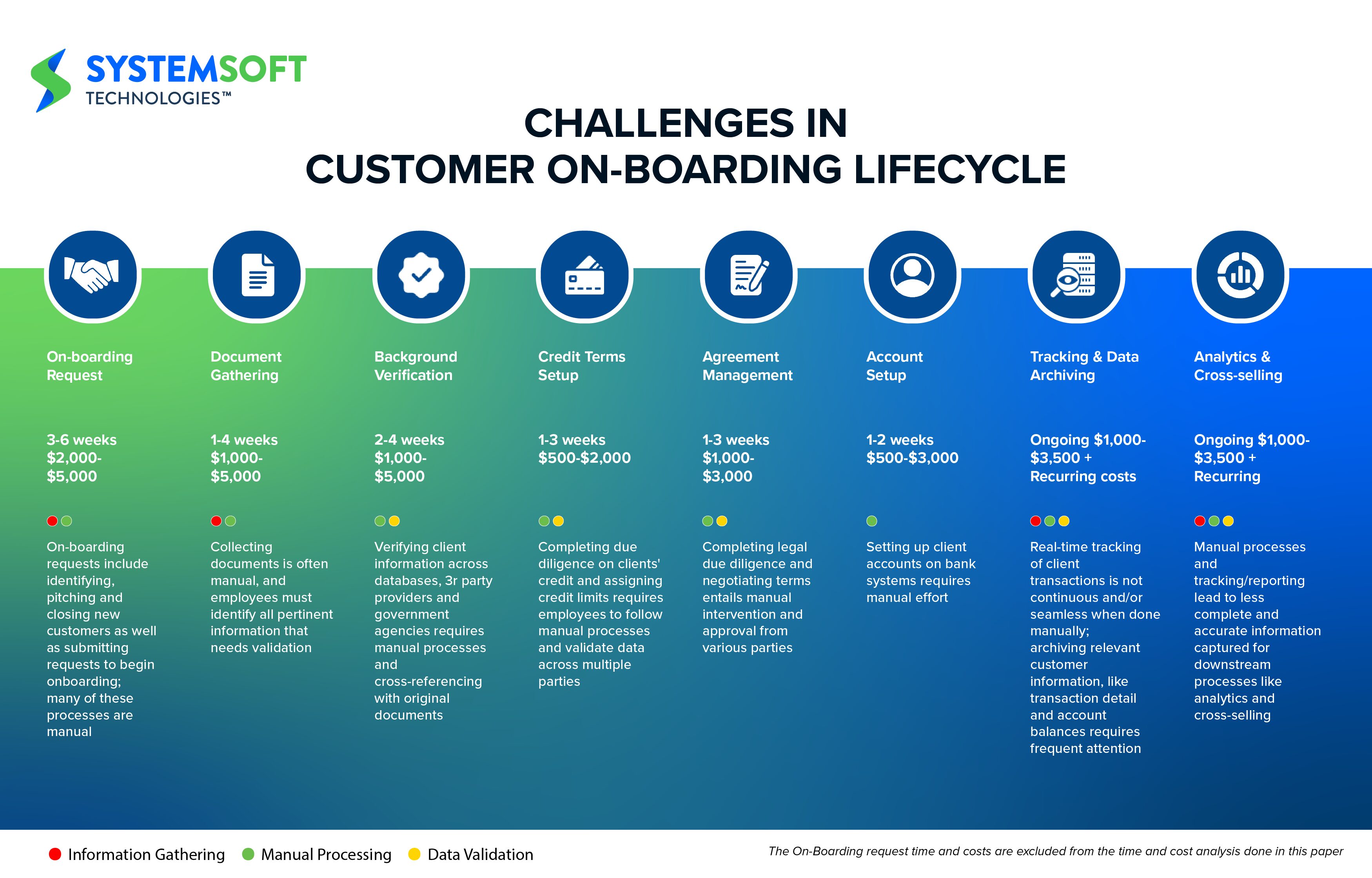

Challenges in Customer Onboarding

It can take up to 100 days to onboard a new corporate client in banks, on average. This lengthy process is not only costly but also inefficient. Banks are looking for ways to reduce the time to onboard customers without compromising security. Automation, artificial intelligence, and data-driven processes can help to reduce this time significantly.

Addressing Implementation Challenges

Overcoming Legacy System Integration Hurdles

Despite the challenges of integrating low-code automation with existing legacy systems, banks can bridge the gap between old and new technologies with careful planning and the right tools.

Training and Adoption Strategies

For a seamless transition to low-code automation platforms, it is imperative to equip employees with the necessary skills. Training and adoption strategies are critical.

Tailoring Solutions

A low-code application needs to be customized according to each bank’s unique needs. There is no one-size-fits-all solution.

Noteworthy Success Stories

Transformation at a Bank

In just one year, a Bank was able to reduce customer onboarding times by 40% and increase customer satisfaction by 18% by leveraging low-code automation.

A Credit Union’s Transformational Journey

Low-code automation enabled a Credit Union to streamline its loan application process, resulting in a 50% reduction in loan processing time, which attracted more customers.

Acknowledging the Human Element in Banking

Banking continues to rely heavily on the human touch, despite the proliferation of automation. Providing advisory services, building and maintaining customer relationships, and responding to complex challenges require the unique skills and expertise of bank staff.

Envisioning the Future of Low-Code Automation in Banking

Increasingly powerful and customizable, these platforms are poised to become even more powerful and versatile in the future. Low-code automation holds significant promise for the banking sector. These platforms are ready to be integrated with emerging technologies, enhanced in security, and further customized.

Prioritizing Customer-Centric Application Development

Businesses can think from a customer’s perspective with low-code platforms. Creating applications that prioritize the user experience becomes easier with a visual development environment and configurable UI components representing user-facing features, backend logic, and integrations.

Using this approach, it is possible to rapidly build a basic yet functional product (MVP), even for complex transactions involving multiple backend systems. As a result of speedy deployment, valuable user data can be collected, allowing for continuous customer experience improvement.

Streamlining Operations: Harnessing 3rd-Party Services and AI Integration

When it comes to the verification of identity, employment, and income, financial transactions can often involve complex procedures that involve multiple steps. Low-code facilitates the efficient and secure completion of digital transactions.

A developer can add essential features to their application environment by simply dragging and dropping them. A combination of artificial intelligence and natural language processing streamlines manual review processes, automates complex decision-making, and provides customers with prompt offers.

Empowering Self-Service User Onboarding Journeys

Developing customer-centric journeys that are compliant, cost-effective, and risk-averse is possible thanks to emerging technology in the banking and financial sector. For new customers to be welcomed to the banking realm, effective Know Your Customer (KYC) and onboarding processes are essential.

Custom user interfaces can be developed using AI-powered APIs, and the right AI techniques can be applied efficiently to deliver exceptional user experiences.

Using this approach minimizes redundant data entry, expedites the onboarding process, automates KYC and due diligence procedures, and improves the overall customer experience.

Adopting a Modular Approach for Rapid Modernization of Legacy Systems

With low-code technology, banks and insurance companies can initiate application development without disrupting their existing infrastructure, providing a nimble alternative to traditional digital transformation initiatives. By leveraging prebuilt APIs and visual development tools, developers can seamlessly integrate front-end processes with customer-facing interfaces.

Without a complete overhaul of current systems, banks are able to update customer-facing applications. As a result, they can maintain a forward-looking strategy while minimizing disruptions to customer satisfaction while adapting to changing business needs.

Adapting to Changing Regulatory Demands

Developers can rapidly build user-friendly front-end interfaces by using an enterprise-grade low-code platform that securely integrates them with data sources.

The ability to make rapid changes to applications in a short timeframe enhances this agility. Banks can deploy front-end solutions and securely embed them into their existing customer portals.

Consider adding a new form to your website for your customers to request a recently launched limited-time credit card offer or implementing a new graphical view for tracking expenses on your customer portal. It does not take months to complete all of this.

Prioritizing Security

Despite concerns about data breaches, regulatory violations, and financial governance lapses, large institutions are reluctant to adopt digital innovation because of security, compliance, and governance concerns.

Enterprise-grade low-code platforms help banks strike the right balance between innovation and security.

These platforms are rigorously tested for vulnerabilities, ensuring robust security and compliance. The development environment significantly reduces the risk of introducing new vulnerabilities.

Evaluating Return on Investment and Identifying Ideal Use Cases for Low-Code Approaches

There are several factors to keep in mind when developing digital and operational applications. It is equally important to carefully identify the most appropriate use cases for low-code tools when developing solutions, even though they can help optimize costs.

Branch-level applications and operational schemas have reduced turnaround times significantly, reducing 3 years of application lifecycle to just 12 months, allowing faster time-to-market.

Conclusion: Low-Code Automation is Revolutionizing Customer Service and Banking Operations

Back-end developers can build front-end applications rapidly using low-code technology, enabling them to unlock a wide range of possibilities. The solutions include streamlining approval processes, developing lightweight microservices, developing Create, Read, Update & Delete (CRUD) applications, and implementing lightweight Extract, Transform, and Load (ETL) solutions.

The banking sector is undergoing a remarkable transformation thanks to the integration of new technologies. Low-code will enable banking institutions to lead innovation, customer centricity, and operational efficiency in a way that has never been seen before.