Financial institutions often find themselves inundated with loan applications, necessitating a thorough credit risk assessment. Traditional methods of evaluating credit risk in commercial lending involve manually sifting through numerous documents, leading to lengthy processing times and the potential for human error.

However, a revolution in credit risk assessment is currently underway.

Traditional Credit Risk Assessment in Lending

In the past, credit risk assessment was a tedious and time-consuming process. Financial institutions primarily relied on manual scrutiny of loan applications. While these methods had their merits, they were far from ideal.

The Need for Automation in Lending

In today’s evolving financial landscape, a more efficient, accurate, and streamlined approach to credit risk assessment is imperative. The manual process often proved to be time-consuming and inefficient.

Advantages of Automated Credit Risk Assessment in Lending

Automated credit risk assessments empower lenders to make informed decisions more swiftly. They also help reduce the likelihood of human error and potential fraud. Automated credit risk assessments offer lenders a comprehensive view of a borrower’s financial history.

Improved Decision-Making in Credit Risk Assessment

Automation eliminates subjective assessments and the possibility of errors in lending decisions by relying on data-driven insights. It enhances decision-making by considering a broader spectrum of information.

Automated credit risk assessment enhances decision-making processes, as opposed to the traditional approach, which may be influenced by bias or incomplete data.

Automated lending overcomes these limitations by leveraging data, evaluating a multitude of factors, and employing advanced algorithms to calculate credit risk more accurately, resulting in better lending decisions.

Reduced Human Error in Credit Risk Assessment

Mistakes are inevitable, and in the financial world, errors can be costly. Automating the credit risk assessment process significantly reduces the margin for human error.

Automated credit risk assessment minimizes the risks associated with human error, regardless of the skill level of the human operator. Human errors such as transposing numbers or misinterpreting applicant data, which can lead to incorrect loan approvals or denials, are nearly eliminated by an automated system.

Data Analysis and Predictive Analytics in Lending

Automation allows for the identification of patterns and trends that humans might overlook, leading to a more precise risk assessment.

Systems with automated data analysis can identify patterns, correlations, and trends that would be impossible for humans to discern within a reasonable timeframe. These systems, based on historical data, can predict future credit behavior, enabling lenders to make more informed decisions and improve their ability to forecast repayment.

Enhanced Customer Experience in Credit Risk Assessment

Automated credit risk assessments expedite loan processing, resulting in faster approvals and happier customers. Borrowers no longer have to endure long waiting periods for loan approval.

Streamlining the entire loan process, from application to approval, is crucial in the fast-paced world of commercial lending. This improved efficiency benefits both the lender and the customer, increasing the likelihood of repeat business.

Compliance and Regulation in Credit Risk Assessment

Financial institutions must remain compliant amid constantly changing regulations. Automation systems can swiftly adapt to regulatory changes, offering a unique advantage.

Regulatory changes are a constant in the financial industry. Lenders must adapt quickly to new rules and requirements to avoid legal difficulties. Automation provides a significant advantage in this regard.

Automated systems can adjust assessment criteria promptly to ensure that lending practices remain compliant with the latest rules, saving institutions time and resources that would otherwise be spent on manual updates and compliance checks.

Future Trends: The Evolving Landscape of Credit Risk Assessment in Lending

Over the next decade, we can anticipate further advancements in automation, including machine learning and artificial intelligence, to make credit risk assessments even more accurate.

Overcoming Challenges and Concerns of Credit Risk Assessment

Banks must digitize their credit processes to thrive in the face of these new pressures. Banking remains a major revenue source for retail, small and medium-sized enterprises (SMEs), and corporations.

Through the digital transformation of credit risk management, banks can expand their business by offering more targeted risk-based pricing, faster client service without compromising risk levels, and more effective portfolio management.

While banks are responding to these trends, progress has been slow. A significant portion of a bank’s costs typically revolves around risk-related processes, and leading banks have begun digitizing core processes. Initially, they focused on retail credit processes due to the substantial potential for efficiency gains.

Mobile applications can be developed to enable the instant origination of tailored personal loans at the point of sale, akin to the digital methods employed by established online retailers.

The digitization of key steps of the credit process, such as automating credit decision engines, has enabled banks to achieve efficiency gains in the SME and commercial banking segments.

Digitizing credit risk and automating credit processes can reduce revenue leakage by up to 10% and save up to 50% in cost savings.

For example, machine learning techniques can enhance credit early warning systems’ predictability by up to 25%, enabling banks to make better risk decisions based on richer insights.

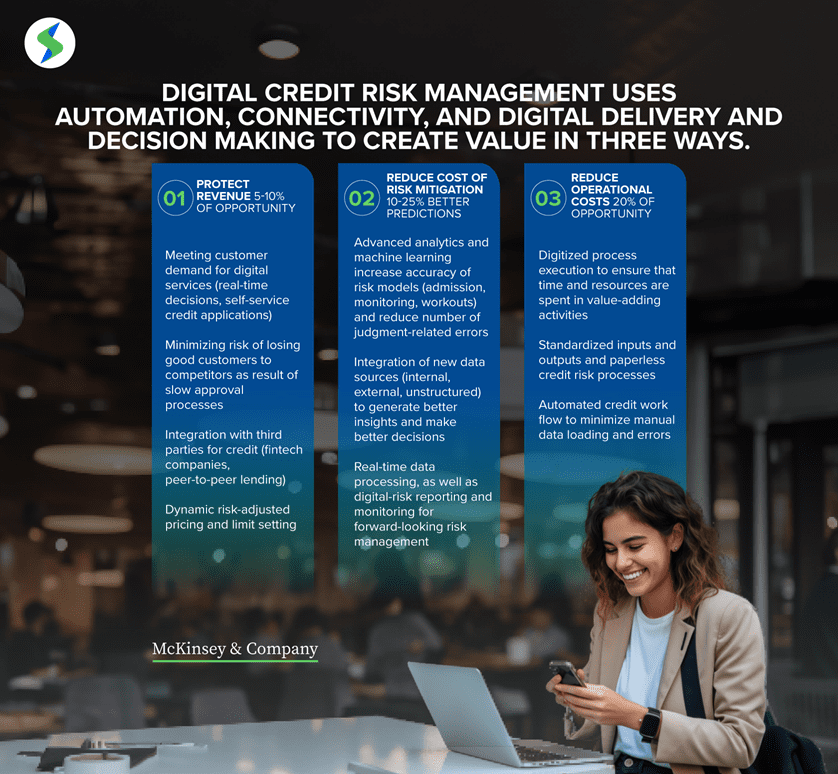

How Digital Credit Creates Value in Lending

Several leading banks have already implemented digital credit initiatives that have generated significant value. Here are a few examples:

Sales and Planning

Imagine a scenario where Relationship Managers (RMs) at an institution have access to a powerful digital workbench. The institution’s transformation team collaborated with IT solutions providers to create a comprehensive suite of front-line tools within a single digital platform.

This platform included product specialists and best-practice CRM approaches. The results were impressive. RMs could now devote more time to engaging with clients, leading to a four to six-fold increase in client interactions, resulting in a 400% increase.

The Mortgage Process

The digital revolution brought significant changes to the mortgage industry. The institution assessed the collateral’s value as a credit risk mitigant using an automated real estate appraisal model based on publicly available sales prices.

Continuous updates with new data made this model as accurate as a professional appraiser. Regulators recognized its excellence, leading to substantial savings for the institution during critical decisions like underwriting and capital allocation.

Additionally, automated customer monitoring and optimized restructuring solutions reduced losses. Decision-making was expedited by 5 to 70 percent thanks to this digital engine, enabling decisions in just a few seconds.

Insights and Analysis

In their transformation strategy, the institution wisely incorporated machine learning to digitize credit risk processes. Machine learning overcame the limitations of traditional statistical analysis and extracted profound insights from vast, intricate datasets.

Machine learning proved especially effective in early-warning systems (EWS). It enhanced EWS during workouts and recovery by providing automated reporting, portfolio monitoring, and case-specific recommendations.

With an astonishing 70 to 90 percent improvement in accuracy, the institution’s model could predict late payments six to nine months in advance of delinquency. This success story illustrates how embracing technology can lead to remarkable success in the financial industry by empowering front-line staff, revolutionizing mortgage assessments, and enhancing analytical capabilities.

The Approach: Working on Two Levels

Working on Two Levels Digitally enabling credit risk management can provide significant value to early adopters. However, realizing a bank’s target ambitions may necessitate a complete transformation.

To achieve this, it’s crucial to build new capabilities across the organization and collaborate closely with the risk function, operations, and business units.

Banks should prioritize areas where digitization can unlock the most value within a reasonable timeframe, given its complexity. Digital strategies can yield substantial results within weeks.

The first step in transforming credit risk is to identify initiatives that are technologically feasible and aligned with core business objectives.

Building digital capabilities can set the stage for the entire transformation after the initial savings are captured. Lessons from early savings can be applied in subsequent phases.

Conclusion

With the aid of digital transformation, existing credit risk processes, tools, and systems can be enhanced to address rising costs, regulatory complexity, and evolving customer preferences.

Using digital technology in credit risk management means automating processes, improving customer experiences, making better decisions, and delivering faster results.

Banks that take action now will gain a competitive edge for years to come as the industry embraces digital risk management within the next five years.