Automation is essential to ensuring that financial institutions provide their customers with seamless, effective, and proactive help in the dynamic world of banking relationships. Modern technologies like artificial intelligence (AI) and machine learning have enabled banks to use automation to respond to customer issues instantly. This change transforms the experience for financial institutions’ customers while helping the former.

This in-depth guide will examine how automation may proactively and in real-time handle customer complaints, assisting financial institutions to function more effectively and efficiently. We will explore all facets of this shift, highlighting automation’s many benefits to the banking customer service industry, from chatbots and self-service choices to personalized responses and analytics.

Automation’s Potential to Improve Banking Customer Service

In 2023, the banking industry underwent a significant transformation, embracing automation as a vital tool for enhancing customer experiences. Automation evolved into an intelligent system, proactively addressing consumer complaints and streamlining repetitive tasks. With the integration of artificial intelligence and machine learning, banks could swiftly collect and analyze customer data, enabling real-time responses to customer needs and concerns. Accenture’s forecasts highlighted AI and ML as major disruptions, driving the industry’s focus with a focus on the following trends:

- In a poll conducted over the past three years, with 784 bank executives and IT experts from roughly 30 countries, 96% said that their firms’ pace of technological innovation had either accelerated or greatly accelerated.

- Since 2019, the banks are offering operations and services enabled by digital technology customized to meet their individual needs and add significant value.

Customers gained from applying these technologies, and the industry was also profoundly transformed. Relevant numbers were cited in Business Insider Intelligence’s AI in Banking and Payments research report:

- In 2023, banks saved $447 billion in costs overall via AI applications, of which $416 billion was saved in the front and middle offices.

- Compared to 46 percent of respondents at banks with less than $100 billion in assets, 75% of respondents at banks with assets over $100 billion in 2023 indicated actively applying AI initiatives.

Chatbots in the front office and anti-payments fraud detection in the middle office were two of the most developed and extensively used AI use cases that had already become prominent in banks’ operations.

2023: Banking Processes Unlocked Hidden Power for Exceptional Customer Experiences

In the evolving landscape of modern banking, prioritizing the customer experience remains paramount. Seamless collaboration among front, middle, and back-office operations is now imperative. Let’s explore this through a common scenario in 2023:

A customer reports a suspected fraudulent credit card transaction, initiating a complex process involving multiple teams and systems. Unfortunately, these teams often work in silos, leading to customer frustration from being shuffled between staff members.

Automation emerges as the solution, streamlining routine tasks and empowering staff to swiftly address customer concerns. End-to-end service automation integrates technologies and data across the bank, enhancing transparency, reducing duplication, and boosting customer satisfaction.

Digital workflows enable real-time collaboration, leveraging AI and predictive analytics to ensure regulatory compliance and enhance user experience. By connecting third-party fintech vendors and legacy systems via a unified automation platform, banks can achieve agility without disrupting current operations.

This transformation not only elevates customer experience but also enhances employee satisfaction. Contrary to belief, automation strengthens human connections, particularly during critical moments where face-to-face interactions are preferred.

According to a 2023 Capco study, 37% of banking customers favor chatbots or text messaging in emergencies, while 63% prefer direct conversations with bank professionals. Automation reinforces the bank-customer relationship, ensuring staff availability for crucial situations.

The future of banking in 2023 revolves around optimizing workspaces, electrifying customer experiences, and responding to real-time demands. End-to-end service automation remains indispensable in navigating the dynamic financial landscape.

Chatbot Evolution in Banking

By 2023, automation, exemplified by the widespread adoption of chatbots, revolutionized modern banking. These AI-powered virtual assistants transformed customer service, offering round-the-clock assistance through mobile apps and websites. Chatbots streamlined interactions, providing quick and accurate solutions while maintaining a personal touch. They handled routine inquiries, allowing human agents to focus on more complex tasks, ultimately enhancing the overall service quality in banking.

Automation and Personalization in Contemporary Banking

Banks now offer personalized experiences by leveraging sophisticated analytics to understand individual preferences and past interactions. Automated systems analyze data to provide tailored recommendations, ensuring customers feel valued and understood. This era of personalization extends beyond simple greetings, offering unique investment insights, assistance in achieving financial goals, and addressing specific concerns.

Predictive Analytics in Banking Customer Service

In 2023, banking automation integrated predictive analytics to foresee customer needs and address issues preemptively. By employing advanced machine learning algorithms and analyzing transaction data, banks could anticipate trends and patterns. This proactive approach enabled institutions to modify strategies or allocate additional resources in response to emerging issues, thereby enhancing customer satisfaction and positioning the bank as responsive and forward-thinking.

Alerts and Real-Time Monitoring in Modern Banking

Automation enables banks to swiftly track customer interactions and financial activities, including online banking and social media mentions. Automatic alerts notify teams promptly of potential issues, facilitating immediate action. This proactive approach demonstrates the bank’s dedication to addressing consumer concerns promptly while maintaining security and trust. Automation thus becomes a vital tool in delivering personalized and responsive financial services in 2023.

Improving Banking Self-Service

Automation empowered consumers to manage their banking experience independently while assisting banks in addressing customer issues efficiently. Self-service options, such as online knowledge bases, FAQs, and troubleshooting manuals, enabled customers to access resources and solutions conveniently through mobile apps and websites. By offering these tools, banks empowered customers to address their financial needs and issues autonomously, thereby reducing the burden on support staff.

Banking’s Simplified Approach to Customer Feedback

In 2023, automation streamlined banks’ feedback processes, providing timely questionnaires and forms to customers after interactions. This automated approach ensured fresh feedback and facilitated efficient analysis, identifying recurring themes and issues. Banks could then allocate resources effectively to enhance the overall banking experience and address common concerns on a broader scale.

Banks’ Integration with CRM Systems

CRM systems remained vital in banking for managing customer data and interactions. Automation seamlessly integrated with these systems, providing banks with up-to-date insights into customers’ financial backgrounds and preferences. This connectivity ensured that every interaction, whether through calls, emails, or chatbots, was logged and linked to the corresponding customer profile. This facilitated faster communication and enabled support representatives to offer tailored financial solutions based on customers’ past interactions and preferences.

Bank Multichannel Support Automation

Customers interact with banks via various channels in today’s varied and linked digital banking environment, from phone calls and emails to social media and live chat. While managing this multichannel environment might be challenging, automation gives banks a practical answer.

A comprehensive picture of the customer’s financial journey could be obtained by centralizing consumer data and interactions from many channels through automated systems. This enabled banks to provide consumers with the same excellent level of banking service regardless of how they chose to interact by allowing them to provide coordinated and consistent support across all channels.

Empowerment of Employees through Automation in Banking

Automation in the fast-paced world of contemporary banking was about enhancing human agents’ abilities and giving them the tools they needed to provide outstanding customer service, not merely substituting people. Financial organizations freed up workers to focus on more complex problems requiring human skill by automating repetitive and routine processes.

This paradigm shift resulted in faster response times and more effective resource allocation, which in turn led to better customer experiences. It also increased work satisfaction within banking support personnel.

Assessing Automation’s Effect on Banking

Setting up key performance indicators (KPIs) and measuring their effects was essential to determining how well automation addressed consumer complaints in real-time. Metrics like issue resolution rates, customer satisfaction ratings, and response times offered important insights into how well automation projects were working.

Banks could optimize their automation initiatives by regularly monitoring and assessing these KPIs by making data-driven decisions. Using an iterative process, automation was made to adapt to the always-changing needs of the banking sector and consumers.

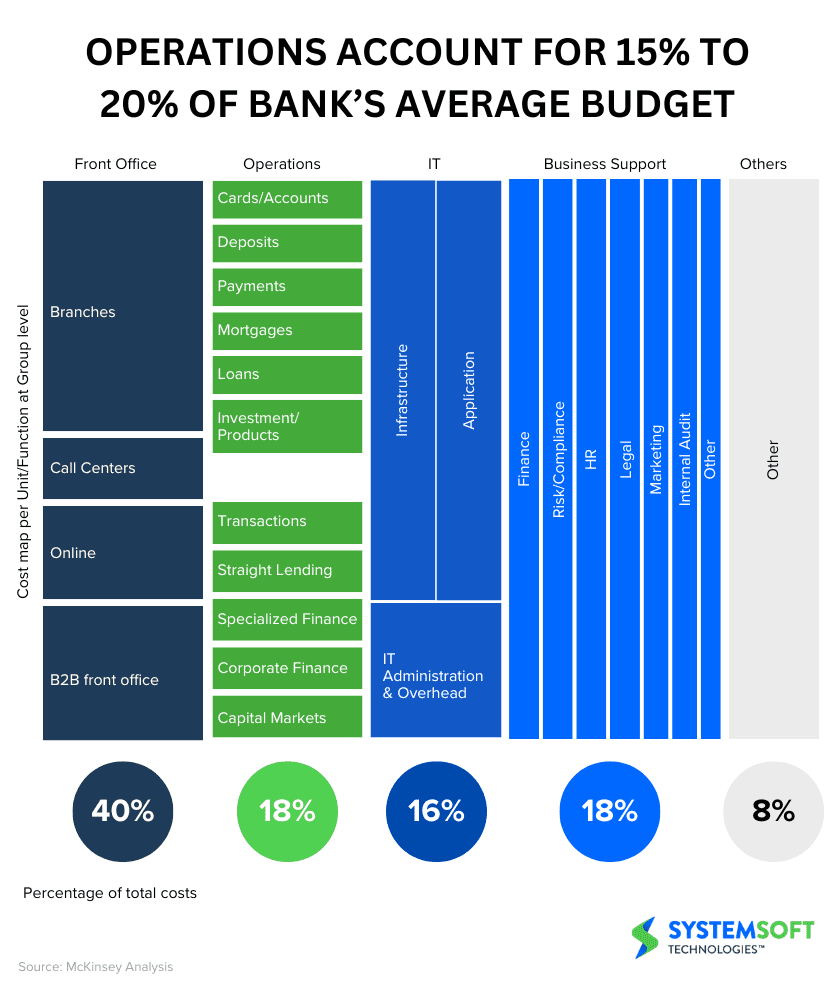

Characteristics of Changing Banking Operations

Today’s financial institutions must discuss the transformative impact of digital technology on banking operations at the board level. Redesigning operations can significantly boost profitability and customer satisfaction. By prioritizing customer needs in process design, banks can drive innovation and improve the customer experience. We’ve identified six key attributes of future banking operations based on insights from leading financial institutions and McKinsey Global Institute research.

Automation’s Role in Bank Customer Service

The banking industry’s use of automation in customer care seemed promising as we approached 2023. Technological advancements like real-time language translation, natural language processing, and sophisticated predictive analytics would enable banks to promptly and proactively address customer problems.

Immersion customer assistance might find new directions with the combination of automation, augmented reality, and virtual reality. Automation would be able to access an increasingly wider range of data sources as 5G and the Internet of Things (IoT) developed, allowing for more responsiveness and customization in banking services.

Redefining Personalization with Unique, Customized Goods and Services

The days of banks providing tightly defined, one-size-fits-all products and services were long gone. The emphasis in the dynamic world of contemporary banking had shifted to giving customers unique, customized experiences. The days of fixed-rate 30-year mortgages, travel rewards credit cards, and savings accounts with minimum balance requirements were quickly disappearing off the face of the earth.

AI and New Technologies’ Role in Automation and Empowerment

Automating repetitive tasks freed up staff to innovate, driving this transformation. Operations teams used automated tools to create unique, customer-focused products like customizable credit cards and loans. These innovations were made possible by leveraging expertise in bank procedures.

Seamless Banking: Streamlining Procedures and Ensuring Quality

The banking sector has adopted advanced technologies and significant automation to enhance customer experience. Integration of artificial intelligence has streamlined business activities, leading to improved customer satisfaction. Digitization of loan processes has drastically reduced approval times from weeks to minutes. AI-powered call centers offer quick, automated assistance, eliminating lengthy hold times. Moreover, AI and analytics have accelerated dispute resolution, providing real-time solutions based on customer data. Automation minimizes errors and biases, allowing employees to focus on complex customer needs, ensuring high-quality service.

Predictive Analytics: Using Proactive Insights to Improve Management

Predictive analytics revolutionized operations management in banks, enabling precise KPIs and tailored offerings based on detailed customer profiles. This predictive modeling not only anticipated customer needs accurately but also preempted potential issues, enhancing proactive customer engagement and overall satisfaction.

Simplifying the Future: Dismantling Siloes in Organizations

The classic banking triangle—front, middle, and back offices—was drastically changing as 2023 approached. AI bots and automation were replacing call centers, while back offices had shrunk as automation took over. Branches were changing in function but in smaller numbers to accommodate the digital era. Employees at front-line branches now served as knowledgeable personal advisers, providing customers with individualized attention and professional advice.

In 2024, talent will be the primary differentiator, enabling exceptional service.

Modern bank operations staff are vastly different, with expertise in data science, engineering, technology, and user experience. They’re more than employees; they’re innovators focused on improving customer experiences. Armed with deep banking system knowledge, empathy, and strong communication skills, they provide personalized “white glove” service, aiming to redefine customer service in the industry.

Conclusion

In conclusion, automation has become indispensable for banks aiming to provide outstanding customer experiences. From proactive chatbots to personalized recommendations and seamless self-service options, automation enables banks to address customer needs efficiently.

System Soft offers expertise in banking automation, streamlining operations, personalizing experiences, enhancing service delivery, and boosting efficiency and profitability. With System Soft as your partner, you can unlock the full potential of automation and excel in the digital era.