Loan Automation Accelerator (LA2)

What if...

a bank or credit union could engage with prospects and customers for loan products via digital, personalized, automated and integrated workflows, without having to choose complex software development?

What if...

a modified off the shelf (MOTs) solution existed that enabled fast implementation and leveraged modern technology in such areas as automation, artificial intelligence, and flexible integration platforms?

What if...

a bank could drive growth of lending portfolios based on personalized information, seamless communication and the ability to exceed expectations of customers for digitized and real-time servicing?

What if...

you could hire full time or contract resources with the right expertise to advance lending automation, expand your internal capacity, or accelerate project delivery.

All of this is possible now!

System Soft Technologies has developed the Loan Automation Accelerator (LA2)

Developed to serve the needs of commercial and consumer lenders who want to:

- Attract and retain more lending customers based on service excellence

- Accelerate customer onboarding

- Redeploy high-cost bank employees - like Portfolio and Relationship Managers - from manual tasks to more valuable endeavors

- Leverage existing systems already in place - like Loan Origination and CRM - yet extend functionality and customer engagement across the workflows of application, underwriting, funding, and servicing

- Better automate workflows, but want a simple, cost-effective approach that yields results in weeks

- Add variable capacity with the right skills to complement internal resources and innovation projects involving workflow automation.

Might your organization be struggling with these challenges?

-

Revenues

Net interest rate margin will most likely be down moderately in 2024 and slowing economic economic activity will require more savvy sales and marketing activities, including the leverage of automation and analytics

-

Expenses

Need to drive more automation across workflows to reduce servicing costs and to handle dynamic and unpredictable servicing volumes and increased funding costs

-

Profitability

Profitability will be squeezed as non-performing loans and write-offs will require more savvy analytics and transparency to borrower financial performance

-

Productivity

Too many high-priced bank resources are immersed in data entry and manual activity that inhibits ability to build stronger relationships and explore more revenue potential

-

Tech Costs

Large COTS platforms are expensive, difficult to implement, and can't be customized for bank workflow nuances. Custom software development takes too long.

-

Expectations

Borrowers' demands for more real-time and digital services continue to grow.

-

Resources

Lack capacity and/or capability to drive automation initiatives.

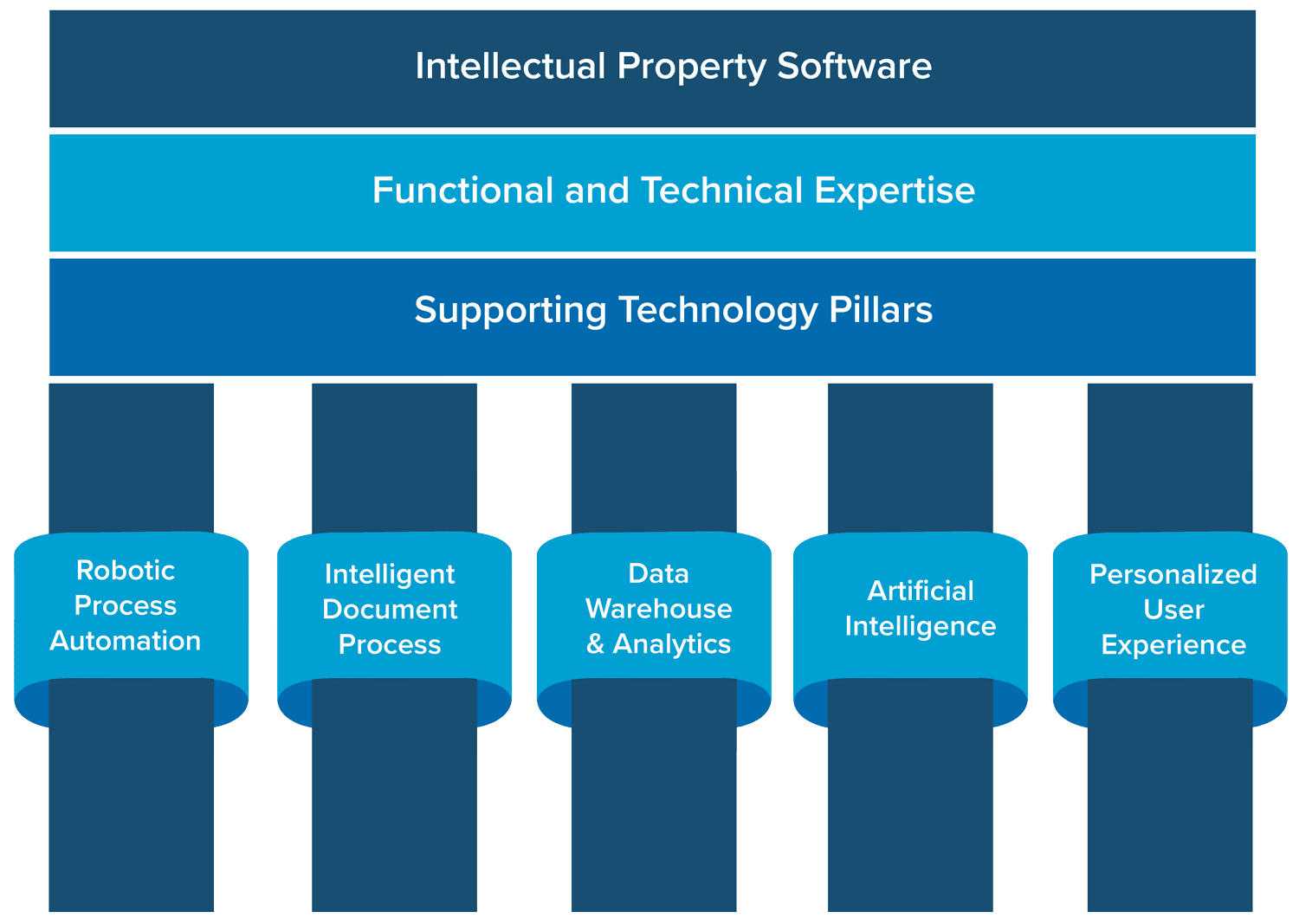

What is LA2?

- Simply stated, LA2 combines expertise with IP to deliver an automated, personalized and digital experience for internal and external lending stakeholders

- Implementation is expedited and integrates with legacy applications and data (e.g., Loan Origination and Core Banking)

- Scope can be tailored to fit the need, whether across all lending functions or specific areas such as origination and servicing

- Technology platforms are selected to align with customer standards and strategy

- Knowledge transfer allows customers to take over ongoing support, modification and maintenance

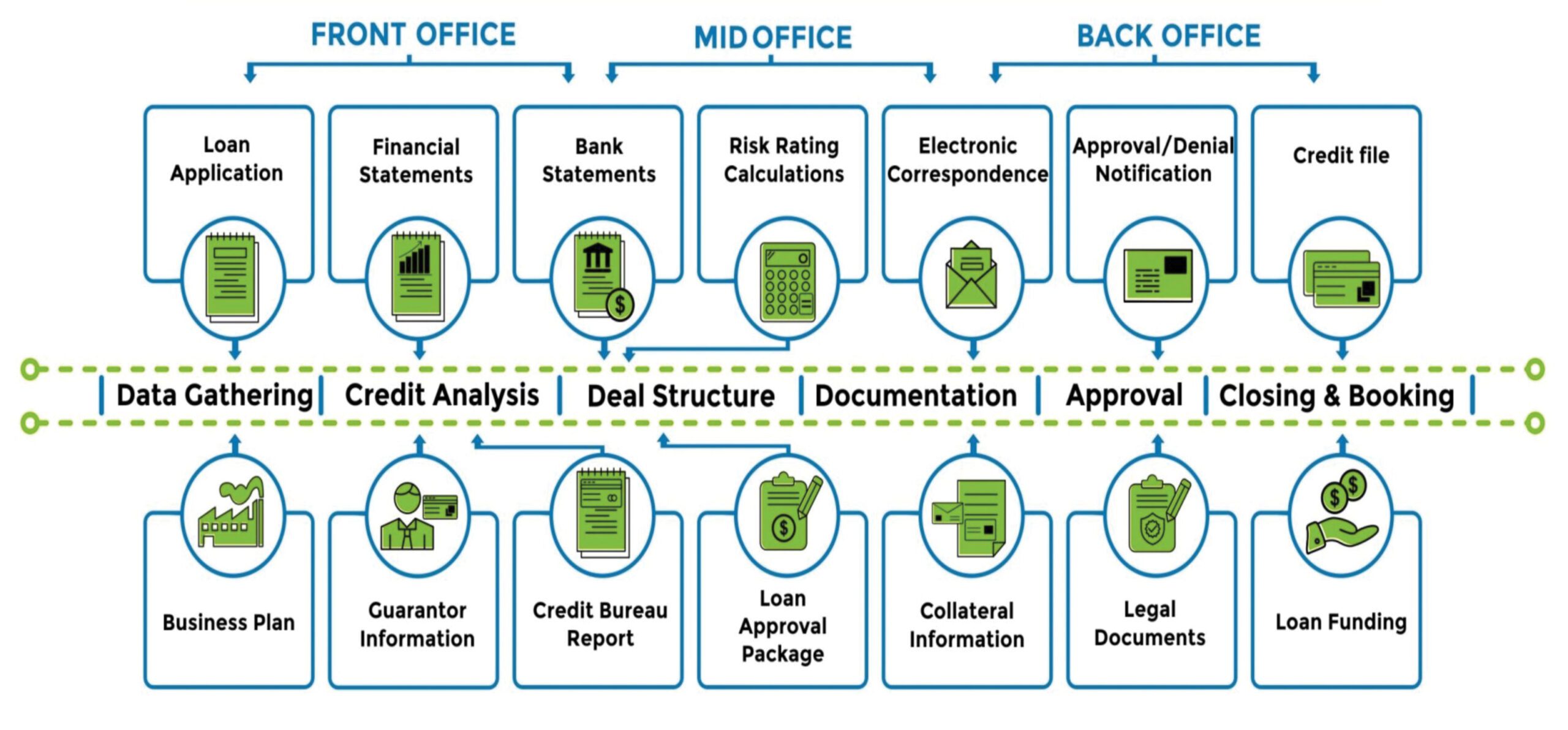

Functional Scope

Roles that System Soft Staffs for Clients

Some clients engage SST on a staffing basis to further their automation ambitions in lending and we can support Direct Hire, Contract to Hire, or Contract / Consulting basis for these roles:

-

Security Analysts/Engineers:

With the increasing frequency and sophistication of cyber threats, cybersecurity professionals are in high demand to protect sensitive financial data, systems, and automated workflows.

-

Data Scientists/Data Analysts:

Financial institutions generate vast amounts of data, and there's a growing need for professionals who can analyze this data to derive insights for automating workflow, fraud detection, customer behavior analysis, and investment strategies.

-

Software and Integration Engineers:

Software engineers to develop, maintain, and develop automated workflows with various financial applications, including trading platforms, banking systems, mobile apps, and customer relationship management (CRM) software.

-

Cloud Architects/Engineers:

Financial institutions are increasingly adopting cloud computing of automated workflows. Cloud architects and engineers are needed to design, implement, and manage cloud infrastructure and services while ensuring compliance with industry regulations.

-

AI/Machine Learning Engineers:

Artificial intelligence (AI) and machine learning (ML) technologies are being used in financial services for automating credit scoring, algorithmic trading, fraud detection, and customer service.

-

Integration Experts:

to connect multiple mid and back-office systems (integration) to create more seamless experiences for employees and customers.

-

Robotic Process Automation Expertise:

assess the workflow landscape to identify optimum use cases, then drive the design, development and integration of intelligent bots to augment and extend people and the digitization of customer experience.

-

IT Risk and Compliance Professionals:

With regulatory requirements becoming increasingly stringent, financial institutions need IT professionals who understand both technology and regulatory compliance. These roles involve ensuring that automated workflows, IT systems and processes comply with relevant regulations and standards.

-

UX/UI Designers:

User experience (UX) and user interface (UI) designers play a crucial role in creating intuitive and user-friendly interfaces for financial applications, websites, and digital banking platforms. Their work directly impacts customer satisfaction and retention.

Case Studies

CAPITAL FUNDING GROUP USES NO-CODE PLATFORM FOR LOAN PROCESS MANAGEMENT

CFG partnered with System Soft Technologies to create a business solution that combines CRM and loan process management. The solution tracks loan metadata and generates tasks for CFG's loan origination team. It was developed using System Soft's Quickstrike methodology and no-code platform, allowing for faster development and a custom software experience.

DownloadTEACHERS MUTUAL BANK CASE STUDY

System Soft Technologies successfully implemented a unified Boomi platform, which led to substantial modernization of Teachers Mutual Bank's legacy banking operations and a significant reduction in integration times. This highlights the challenges faced by credit union leaders in deploying technology and the tailored solutions offered by System Soft to support financial institutions. This transformative engagement underscores the potential for digital business strategy enhancements and the seamless integration of innovative financial technology offerings.

DownloadREGIONAL BANK CASE STUDY

A regional bank's initiative to provide financial education to individuals without formal knowledge attracted over 6 million subscribers, contributing to an estimated $200 million in yearly revenue. System Soft Technologies collaborated with the bank to develop an architecture aligned with the bank’s marketing technology stack, resulting in a successful and cost-effective campaign.

DownloadMORTGAGE LOAN ORIGINATOR CASE STUDY

Credit union leaders face the daunting task of implementing and expanding technology to meet today's urgent demands. With members and employees increasingly relying on virtual services, alongside the growing threat of unpredictable security risks, the challenge is formidable. Compliance requirements are also becoming more complex to manage, while costs are rising, and data scalability and integration are becoming increasingly intricate. At System Soft, our banking and credit union experts provide integrated services using delivery accelerators to support financial services leaders who are eager to address these challenges swiftly and effectively.

DownloadCOMMERCIAL LOAN ORIGINATION

Utilizing our QuickStrike rapid application development approach and a leading no-code platform, System Soft has successfully constructed an Intelligent Automation CRM-like application with document tracking capabilities for each loan. This comprehensive system encompasses multiple workflows to manage assignments and approvals, and is in active use across the entire division, spanning from loan originators to back-office staff and bank executives.

FINANCIAL SERVICES ORGANIZATION

A financial services organization in Detroit and Michigan struggled to find local talent for a project requiring expertise in React, Angular, and JavaScript. System Soft Technologies quickly identified suitable contract resources and helped the client make successful hires. The client praised System Soft's professional and technically sound IT recruitment process. Their strategic IT staffing solutions simplify recruitment processes and offer access to a global talent network and diverse engagement models while enhancing efficiency and minimizing operational costs for organizations.

DownloadA NO-CODE EARLY WARNING SYSTEM HELPS PREDICT AND PREVENT FINANCIAL DISTRESS

"In the current unpredictable economic environment, the ability to forecast and avert financial turmoil is vital for the stability and advancement of any enterprise. By leveraging System Soft's tailored no-code application, you can obtain immediate insights into your financial well-being and proactively pinpoint potential risks before they become critical. Our adaptable and economical development platform guarantees a rapid, personalized solution aligned with your distinct requirements and financial constraints.

DownloadContact Us

For additional Information on the Loan Automation Accelerator (LA2), give me a call or reach out via the contact form below:

Andrew Vincent

727-723-0801 X711

andrew.vincent@sstech.us