How Digital Transformation in Banking Leads to Better ROI

Witness a digital transformation in banking trends. Historically, financial institutions have the reputation of valuing numbers over people. That means customer service has taken a back seat.

However, today, users have endless choices for their financial services. And it’s imperative banks understand how to prepare for the future of banking.

Digital adoption in banking and financial services has raised the bar for customer expectations of convenience and innovative digitization. With the economic challenges of the COVID-19 pandemic, customer desire for simple, quick digital interactions are at an all-time high. This, in turn, has put pressure on banks to improve customer experiences and streamline processes.

Customer-Centered Approach

Forbes finds the evolving relationship between customers and their banks has been fast-tracked by the pandemic. This is setting the stage for a digitally focused banking future. The stressed economic environment has left customers with a greater need for financial advice. And increases in remote work have created an openness to receiving this advice remotely.

Now, a customer-centered approach is fundamental to the success of financial services. And innovating to overcome UX pain points in the banking sector leads to a better return on investment.

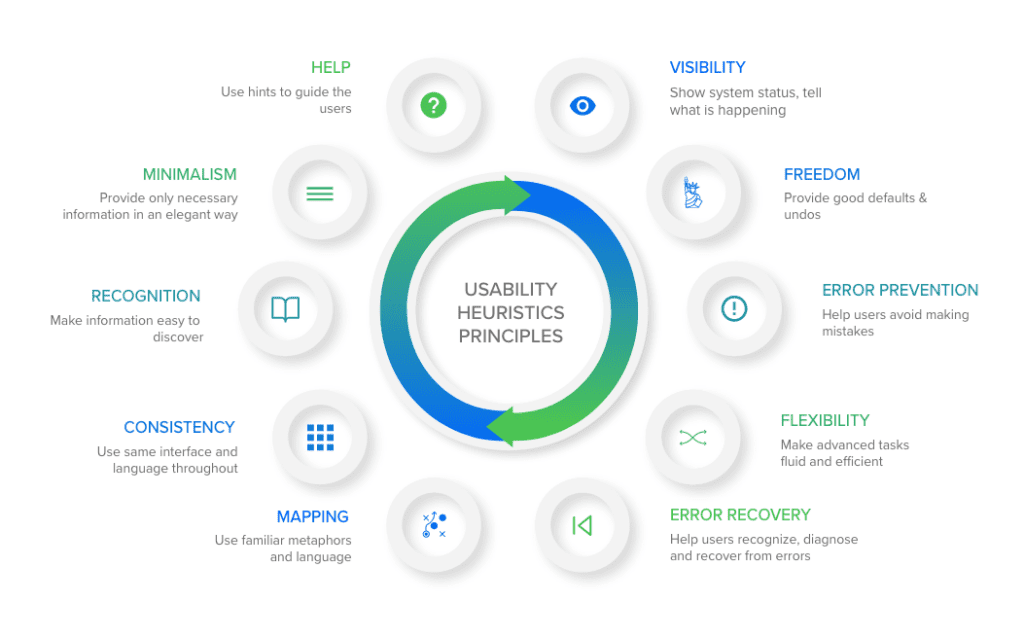

Based on System Soft’s Heuristic Evaluation Principles, it’s been sadly found that banking and financial institutions often don’t provide a seamless experience for customers or meet their needs.

Here are the top 12 common user experience pain points that limit a banking customer’s ability to positively engage with a bank’s website or customer portal.

Based on these UX pain points, System Soft recommends four areas of innovation. These can help banks prepare for the changing financial landscape and successfully meet customer needs.

Top 12 Most Common UX Pain Points in Banking

- Most banks are not using their online accounts as effective differentiators.

- Users cannot demo online accounts to see unique experiences offered.

- Comparing the unique sales propositions of various accounts is more difficult than it should be.

- Users need to clearly see the benefits of each account type (e.g., rates and fees).

- Credit card pages, such as Discover, do a more effective job.

- Opportunity to create a quiz to find the best account fit.

- Inability to schedule appointments with local advisors online for existing account holders.

- Existing account holders must be able to set up virtual meetings to discuss several topics (e.g., mortgages, auto financing, etc.). Digital office hours are important.

- Banks have slowly become more of a utility than a value-add for customers.

- Banks need to rethink how they are adding value to their customers.

- Opportunity to become financial advisors with various tools (e.g., loan calculators, investment calculators, budgeting tools, credit scores, etc.)

- You must keep your customers on your page to prevent them from using a competitor’s tool and potentially moving their account(s).

- Bank partnerships and opportunities to save money or find discounts are often too difficult to find.

- Users do not have a high personal stake in deep-diving bank pages. As such, any information that’s obscured may as well not exist.

- Banks are not providing more information to non-finance savvy customers.

- Many banks don’t define terms or concepts like CD, FDIC insured or APY.

- These UX pain points can be fixed by creating a simple modal pop-up, which provides information when users hover over such terms.

- Many banks are behind the times when it comes to web accessibility.

- Web pages need options for those customers who need help reading, typing, moving their mouse, etc.

- Many banks are undervaluing educational content.

- Users are looking for a financial partner.

- If a customer’s bank doesn’t have calculators, investing advice, etc., he or she will go to another website and potentially be exposed to a competitor.

- Navigating banking websites can be difficult, leading to user error and frustration.

- Many sites are not using sticky navigation menus.

- Navigation styles change as users navigate through the site.

- Opening an account or applying for financing processes are outdated.

- Many of the forms tested weren’t following industry best practices.

- While making fees difficult to understand and researching an effective business strategy, it damages long-term customer loyalty.

- Transparency and expectation management is the key to establishing long-term partnerships with your customers.

- Lack of customized UX (user experience).

- Banks don’t differentiate their products and services based on the information they have about their customers (e.g., credit score, spending patterns, loan information, etc.).

4 Ways System Soft’s UX Team Implements Innovation and Digital Transformation in Banking

1. One-Stop Money Management

Banks need to offer a one-stop shop for customers’ financial needs and questions. This all-in-one platform helps them compare accounts and financing options. And calculate loans, retirement savings, long and short-term investments and budgets. Also, invest to meet their financial goals.

The bank uses spending information to provide a budgeting tool, so customers know where they are spending their money. This tool makes suggested spending habit changes and maps these changes to personal financial goals and suggested financial strategies (e.g., investing in the stock market, a CD or government bond). The suggestions can become more targeted if a customer preference center is created where users provide individual information about themselves.

Your customers can’t be navigating away from your branded pages to educate themselves through sites like NerdWallet; check their credit scores or budget with systems like Intuit’s Mint.

The banks can provide this information and these services, and better (save credit scores). Intuit’s Mint suffers from unclean data, requiring the user to make changes based on the program’s initial interpretation of the expenses. The banks have much richer data about where that money went. And they can create a program that requires significantly less user effort.

2. Leveraging Augmented Reality Tech

Most modern phones can use augmented and mixed-reality software. Banks must use this technology to help customers find ATMs and other financial areas of interest with their phones. This may be particularly useful for travelers.

- The augmented reality (AR) ATM finder will show users exactly where to find an ATM and which ATMs in the area are free, low-free or reimbursable.

- The AR feature will only be activatable if there are ATMs in a nearby geographic radius (e.g., two miles). Otherwise, a list of nearest ATMs with the same information will populate the page, with the option to get directions from a map service like Google Maps.

- Further, the AR feature must allow users to find the location where they receive rewards points, cash back or other incentives based on the data the bank has about the user (e.g., veteran, older than 55 years, etc.).

3. Pain-Free Travel

Traveling across the nation or internationally can lead to painful and embarrassing situations. Banks need to use GPS data and user input for a more pleasing experience.

- For customers with mobile apps, banks must use the phone’s location data to figure out if they are in a foreign location. Then they can send a push notification that routes the user to sign in at a landing page, where they can confirm they are in a foreign location.

- Customers must be able to preemptively log in and inform their bank they will be travelling to specific locations. The bank must then populate relevant information about ATM availability. And, if applicable, where the customer can exchange their currency for local currency (i.e., names of services with location information, including integration with a map service).

4. Gamified Savings

Getting children to learn valuable skills and lessons about saving money is difficult. Banks can earn the loyalty of parents and potentially the children as they age by providing a gamified savings experience.

- Children who open an account will have access to a mobile app, where they can create an avatar and a pet.

- The children can “purchase” assorted items and skins for their avatar and pet by saving money. The “purchase” is made by increasing the savings balance in their account.

- The savings balance must not be accessible through this app, so children can show off their avatars and pets to each other.

- The “purchases” must not be based on dollar amounts in the account. Instead, on percentage increases in savings, allowing children of any socioeconomic status a more equal chance to take part and make purchases that interest them.

- Ideally, a mobile gaming experience with avatars and pets can be incorporated to encourage sustained interest.

Conclusion

Banking customers today have come to expect a seamless digital experience. That comes thanks to Amazon and other such online organizations. Between the traditional brick-and-mortar banks and online banks competing for customers’ attention, customers have countless choices.

And because switching between financial institutions is easy in this digital world, holding customer loyalty is challenging work. This creates a challenge for financial institutions, especially if their products or services are subpar to their competition.

The flexibility of having a local branch nearby is valuable. But so is banking at your fingertips. Delivering a seamless experience in the digital world requires some effort on the bank’s part. They must deliver a high-quality experience to better understand their customer, their needs, what’s working and what’s not working from a user’s perspective. That is the science and art of UX (user experience).

Greater UX and Quality Service

Financial institutions can deliver a great user experience and quality service to their customers by using UX expertise and processes. Many customers want all their financial needs to be met in a single digital outlet. If banks can deliver commercial, retail, and loan services, and investment offerings in one place through an easy-to-use platform, then increased revenue and customer loyalty will follow.

Many of the UX pain points highlighted in this article are solvable with UX services. System Soft Technologies provides premium UX services in a cost-effective way. System Soft uses state-of-the-art UX processes and world-class UX expertise to solve UX pain points, deliver improved products and services to customers.

Please contact System Soft to learn how you can deliver a high-quality user experience to your financial institution and banking customers. Email Imran Riaz to schedule a complimentary UX evaluation.

About the Author: Imran Riaz

As Head of UX at System Soft Technologies, Imran engages with customers to best understand their needs, values, abilities, context and limitations, then delivers outcomes that are innovative and delightful. As a global UX executive and thought leader, he fuses customer perspectives with business goals, technology and value creation.